Investments in Regenerative Economies

Alongside the primary work of providing general operating support grants, Ceres Trust makes investments that reflect a vision holding ecosystems as sacred and foundational to all life, and the belief that right relationship between humans and the earth, and between one another as people, are tantamount to our ability to survive and flourish.

Partners

Agri-Cultura Network

A community driven model building New Mexico’s small farming economy, promoting nutrition and economic development through traditional and innovative agricultural practices.

Agriculture and Land–Based Training Association

Creating opportunities for low-income field laborers through land-based training in organic farm management.

Black Farmer Fund

Creating a thriving, resilient, and equitable food system by investing in black food systems entrepreneurs and communities in New York.

Black Land and Power

A coalition aimed at developing Black leadership, supporting Black communities, organizing Black self-determination, and building institutions for Black food sovereignty & liberation.

California FarmLink

Investing in the prosperity of farmers and ranchers through lending, education, and access to land.

Hawai’i Investment Ready

Supporting the people and organizations addressing Hawai’i’s social and environmental opportunities by accelerating social enterprise impact and access to investment.

Hawai‘i ‘Ulu Cooperative

Committed to the revival of ‘ulu to strengthen Hawai‘i’s food security and to the value of aloha ‘āina (love for the land) by using environmentally responsible growing and production methods.

Healing Soils Foundation

Healing Soils Foundation supports regenerative farmers in their efforts in Healing People, Healing Our Communities and Healing Our Earth.

Jubilee Justice / Potlikker Capital

Supporting Black farming communities through new models of regenerative farming, cooperative ownership and access to new markets.

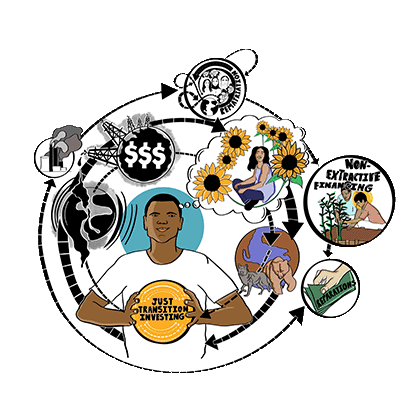

Just Transition Integrated Capital Fund

A new model for philanthropy, the Just Transition Integrated Capital Fund offers foundations a learning vehicle to move endowed assets to BIPOC and working class controlled funds and grassroots projects through non-extractive financing in the form of 0% loans and catalytic grants.

Oweesta Corporation

The only existing Native CDFI intermediary offering financial products and development services exclusively to Native CDFIs and Native communities.

Rural Coalition / Coalición Rural

A voice for African-American, American Indian, Asian-American, Euro-American and Latino farmers, farmworkers, and rural communities in the US, indigenous and campesino groups in Mexico, and beyond, for 40 years.

Seed Commons

A national network of locally rooted, non-extractive loan funds that brings the power of big finance under community control.

Approach

Ceres Trust investment strategy and practice are guided by the following questions and aspirations, acknowledging that our practice and investments exist across a spectrum of alignment with these priorities. We are continually learning, and invite feedback and dialogue to strengthen practice and possibility for transformative investments.

- Does the investment advance the mission to support healthy and resilient farms, forests, and communities, and the ecosystems upon which we all depend?

- Does the investment acknowledge, tend to, and undermine the intertwined root causes of harm: dehumanization, economic inequality, and ecological catastrophe.

- Are those most harmed by extractive systems at the center of the solution? Is the investment responding to a movement or field need?

Priorities

Priorities for Ceres Trust Aligned Investment Portfolio:

- Support for a Just Transition in communities that have been on the front lines of extractive, industrial agriculture and other industries.

- Community leadership in determining needs and finance strategies for a transition to regenerative economies in rural places.

- Soil health building investments that are non–extractive.

- The dire need to expand access to capital for organic small scale farmers in general; especially those who have been historically underserved or intentionally disenfranchised, including African American farmers, Indigenous people, and farmworker/Indigenous/Latinx farmers.

- Creative strategies to redistribute and secure access to land (stewardship) and return or facilitate ownership/stewardship of land by those with the values, commitment, persistence, knowledge to right the relationship to the land, follow the lead of the land and her people, persist through reactionary assault.

In addition, we have learned from movement partners that:

- Place matters, and the most responsive and transformative investments will likely work in regions Ceres Trust already has relationships and does general grantmaking.

- Relationships matter: these investments succeed when both partners/all parties succeed. Relationships that allow creative strategizing and support across the traditional lines of “lender” and “borrower” are essential. Learning how to create non–extractive financial partnerships is essential.

- The approach and culture of relationship with the land is essential to interrogate with potential investment partners to ensure they align with Ceres Trust.

Guidance

Ceres Trust’s aligned investment approach and strategy was developed with leadership from Anthony Chang, Kitchen Table Advisors, in consultation with many people, including:

Movement and field partners:

- A-dae Romero-Briones, First Nations Development Institute

- Chrystel Cornelius, OWEESTA

- Brendan Martin and Marnie Thompson, Seed Commons

- Eduardo Rivera, Sin Fronteras Farm

- Pakou Hang, Hmong American Farmers Association

- Tamara Jones, SAAFON

- Tim Lampkin & Leonette Henderson, Higher Purpose

- Edna Rodriguez & Tahz James, RAFI

- David Mancera, Kitchen Table Advisors

- Mai Nguyen, Minnow

- Reggie Knox, California FarmLink

- Helga Garza, Agricultura Network

- Larisa Jacobson, Soul Fire Farm

- Qiana Mickie, Just Food

Investment partners and/or connectors:

- Esther Park, Cienega Capital and No Regrets Initiative

- Leslie Christian, Northstar Asset Management

- Tiffany Brown, Chordata Capital

- Konda Mason, Jubilee Justice;

- Lynne Hoey, Candide Group

Key learning gatherings:

- HEAL Food Alliance Summit in Albuquerque May 2019

- Carbon Sink Farming Convergence in San Diego November 2019

- Equitable Food & Farm Financing in Little Rock, AR November 2019

- CA Farmers of Color convening in Paicines, CA in December 2019

- Justice Funders Maestra Program participants, State of the Movement 2020 preparations

Stories

What does it look like for 12 Black food actors to come together at the table (or in this case, zoom!) and make decisions around funding that would significantly impact the future of 8 food businesses in NY? What does it mean for an institution to invest, with the criteria for being funded centered on environmental impact, community well-being, and economic justice? How can honoring the realities that entrepreneurs face by involving them in the underwriting process mean for the impact of investment? Black Farmer Fund, an emerging community-governed investment fund, explored these questions through their recent pilot phase.

2021 was a year filled with growth, learning, deepened relationships, and most notably, our first experience redistributing capital into the hands of black agricultural businesses. We successfully raised a $1M pilot fund from individuals and institutions, and have so far deployed various combinations of integrated capital to eight transformative businesses. We are excited to share with you our 2021 Annual Report!

read more...